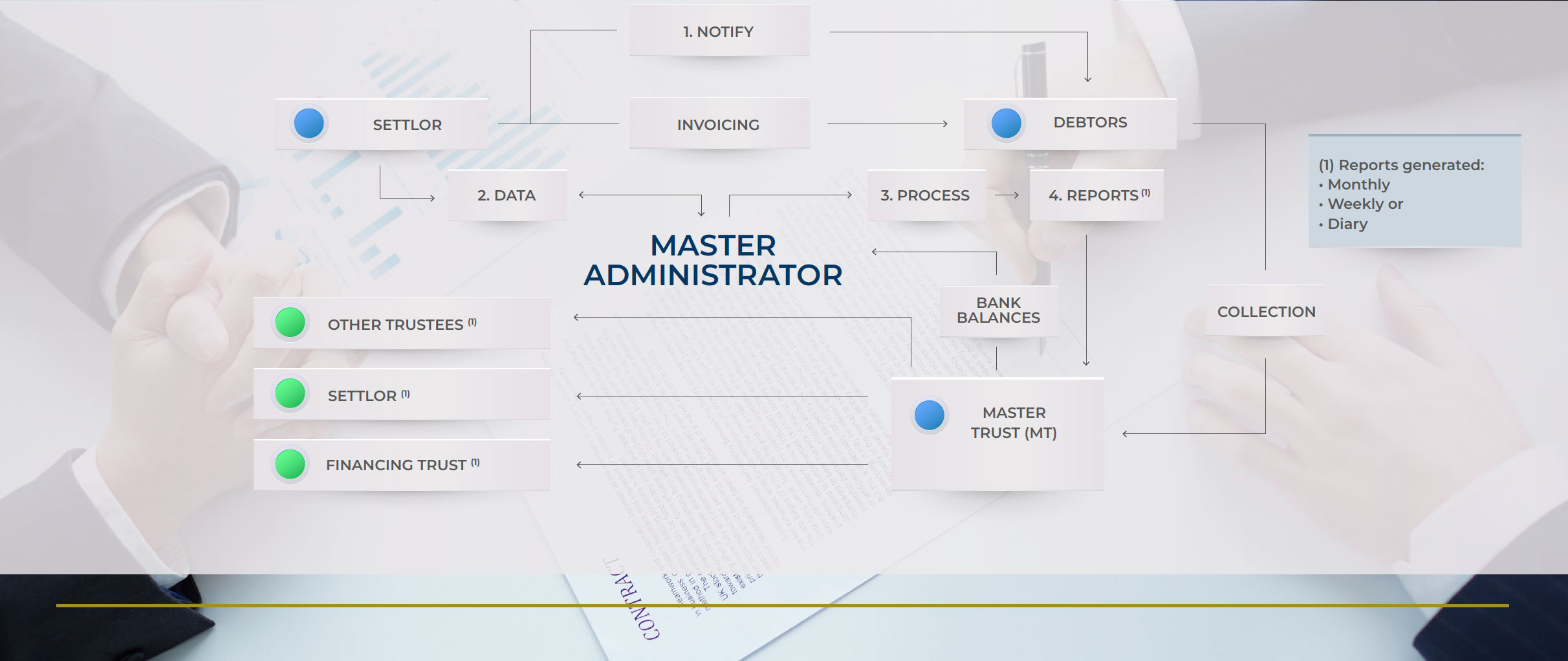

MASTER SERVICE TO COLLECTION TRUSTS

The future of master service.

Control of your management cash in one place.

MASTER SERVICE OF FUNDING TRUSTS

ADMINISTRACIÓN MAESTRA DE FIDEICOMISOS DE FINANCIAMIENTO

Experience

Experience in all types of Structured Financing transactions.

Analisis

Analysis focused on excellence in the performance of Managed Portfolios.

Administration

Manage daily transactions, based on technology adaptable to the needs of the settlors.

Technology

We have the latest in Systems Technologies, developed internally (in-house) and totally via the Web.

Efficiency

Easy access to information for each of our Settlors and participants in the Trusts under servicing.

Ability

Understanding each Financing Structures, providing added value in the implementation of the transaction.

Let’s start

Write us and get to know your best option…